Multiple Choice

Use the following information for questions 34-35.

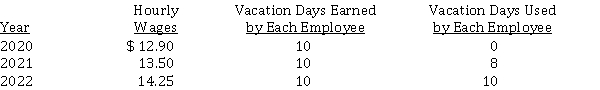

Silver Ltd. has 35 employees who work 8-hour days and are paid hourly. On January 1, 2020, the company began a program of granting its employees 10 days paid vacation each year. Vacation days earned in 2020 may be taken starting on January 1, 2021. Information relative to these employees is as follows:  Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

-What is the amount of the Vacation Wages Payable that should be reported at December 31, 2022?

A) $ 39,900

B) $ 45,360

C) $ 47,460

D) $ 47,880

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Which of the following statements is INCORRECT

Q22: Common types of current liabilities<br>Define and identify

Q23: Corporation income taxes payable<br>A) must always be

Q24: A constructive obligation arises when<br>A) the entity

Q27: Jackpine Trading Stamp Co. records trading stamp

Q28: Lee Kim Inc.'s most recent statement of

Q29: Warranties<br>Alaska Computer Company sells computers for $

Q30: issues a $ 250,000, three-month zero-interest-bearing note

Q31: Use the following information for questions 43-44.<br>Antimony

Q37: A liability for compensated absences such as