Multiple Choice

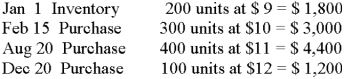

Moss Co. uses the FIFO method to calculate ending inventory. Assuming 300 units are not sold, the cost of goods sold is:

A) $7,600

B) $7,280

C) $3,120

D) $3,400

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q35: Given: Department A. 8,000 sq. ft., Department

Q39: Melissa's Dress Shop's inventory at cost on

Q40: Molls Co. allocates overhead expenses to all

Q46: The retail method:<br>A) Is not an estimate<br>B)

Q48: A company can change from LIFO to

Q55: Javon Corp. had a beginning inventory of

Q55: Overhead expenses are:<br>A)Directly related to a specific

Q57: Calculate inventory turnover at cost (to nearest

Q59: Calculate estimated cost of ending inventory using

Q62: Ron Co. has a gross profit on