Short Answer

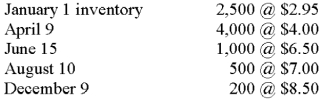

Given the following information, you have been requested by your supervisor to submit the cost of ending inventory under LIFO, FIFO, and weighted average. At year end 850 units remained in inventory.

Correct Answer:

Verified

$2,507.50 (LIFO); $6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Overhead expenses are allocated to particular departments:<br>A)Strictly

Q3: To use the retail method of estimating

Q9: A perpetual inventory system continually updates inventory

Q21: Using the retail method, could you calculate

Q30: Allison Co. has a beginning inventory costing

Q53: During inflation, the best method to use

Q54: Overhead expense can be allocated to particular

Q64: The weighted-average method is best used:<br>A)For heterogeneous

Q83: In specific identification, which one is not

Q93: The gross profit method is a way