Short Answer

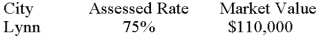

Calculate the assessed valuation:

Correct Answer:

Verified

$82,500

.7...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$82,500

.7...

.7...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q4: The tax rate of $.0984 in decimal

Q14: Assessed valuation is equal to the assessment

Q28: Calculate the assessed valuation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7808/.jpg" alt="Calculate

Q31: Calculate amount of tax due: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7808/.jpg"

Q57: Usually assessed value is rounded to the:<br>A)Nearest

Q61: Sales tax is required in all states.

Q80: Excise tax and sales tax are really

Q85: Tax rate per dollar is calculated by

Q87: Pete's Warehouse has a market value of

Q104: Sales tax is taken on shipping charges.