Multiple Choice

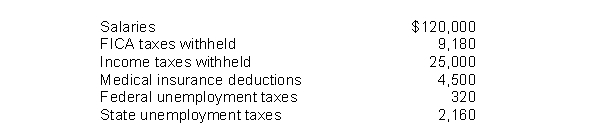

The following totals for the month of April were taken from the payroll records of Noll Company.  The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $2,480.

B) debit to Payroll Tax Expense for $11,660.

C) credit to FICA Taxes Payable for $18,360.

D) credit to Payroll Tax Expense for $2,480.

Correct Answer:

Verified

Correct Answer:

Verified

Q53: When authorizing bonds to be issued the

Q231: Mohling Company typically sells subscriptions on an

Q232: Warner Company issued $5,000,000 of 6%, 10-year

Q234: Bonds that are issued against the general

Q235: Bonds are not always categorized as<br>A)callable or

Q237: Tina's Boutique has total receipts for the

Q238: Foley Company issued $2,000,000 of 6%, 5-year

Q239: On January 1, Sewell Corporation issues $3,000,000,

Q240: Unearned revenues are received before goods are

Q241: The effective-interest method of amortization of bond