Multiple Choice

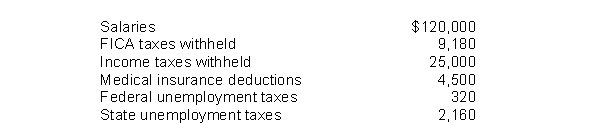

The following totals for the month of April were taken from the payroll records of Noll Company.  The entry to record the accrual of federal unemployment tax would include a

The entry to record the accrual of federal unemployment tax would include a

A) credit to Federal Unemployment Taxes Payable for $320.

B) debit to Federal Unemployment Taxes Expense for $320.

C) credit to Payroll Tax Expense for $320.

D) debit to Federal Unemployment Taxes Payable for $320.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Each bondholder may vote for the board

Q10: Morales Company issued $800,000 of 8%, 5-year

Q11: A corporation that issues bonds at a

Q13: An unsecured bond is one that is

Q16: Sparks Company received proceeds of $634,500 on

Q17: Sparks Company received proceeds of $634,500 on

Q18: If a bond has a stated value

Q19: When the straight-line method of amortization is

Q20: The amortization of a bond premium will

Q90: Current liabilities are expected to be paid