Multiple Choice

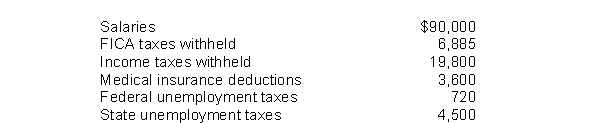

The following totals for the month of April were taken from the payroll records of Metz Company.  The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $12,105.

B) credit to Payroll Tax Expense for $12,105.

C) credit to FICA Taxes Payable for $5,220.

D) credit to Payroll Tax Expense for $5,220.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: The higher the sales tax rate the

Q62: If bonds are issued at a premium

Q134: Unearned revenues should be classified as Other

Q135: If the market rate of interest is

Q136: The debt to assets ratio measures the

Q140: The current carrying value of Kennett's $800,000

Q141: The current carrying value of Pierce's $1,800,000

Q142: An $800,000 bond was retired at 98

Q144: A corporation issues $300,000, 10%, 5-year bonds

Q205: Sales taxes collected by a retailer are