Multiple Choice

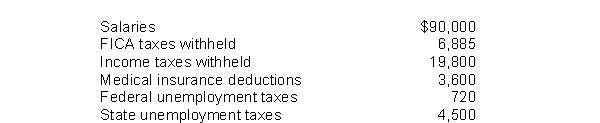

The following totals for the month of April were taken from the payroll records of Metz Company.  The entry to record the accrual of federal unemployment tax would include a

The entry to record the accrual of federal unemployment tax would include a

A) credit to Federal Unemployment Taxes Payable for $720.

B) credit to Federal Unemployment Taxes Expense for $720.

C) credit to Payroll Tax Expense for $720.

D) debit to Federal Unemployment Taxes Payable for $720.

Correct Answer:

Verified

Correct Answer:

Verified

Q99: Current liabilities are due<br>A) but not receivable

Q187: In a recent year, Garvey Corporation had

Q188: On January 1, 2020, $4,000,000, 5-year, 10%

Q190: When the effective-interest method of amortization is

Q191: The interest charged on a $350,000 note

Q193: If the straight-line method of amortization is

Q194: Very often, failure to record a liability

Q195: Secured bonds are bonds that<br>A)are in the

Q196: A corporation issues $300,000, 8%, 5-year bonds

Q197: An installment note calling for equal total