Multiple Choice

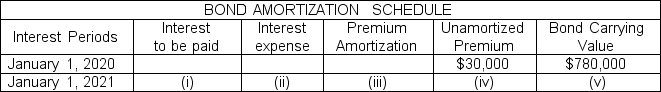

The following partial amortization schedule is available for Courtney Company who sold $750,000, five-year, 10% bonds on January 1, 2020, for $780,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (i) ?

Which of the following amounts should be shown in cell (i) ?

A) $78,000

B) $81,000

C) $75,000

D) $15,000

Correct Answer:

Verified

Correct Answer:

Verified

Q37: A $150,000 bond with a quoted priced

Q39: The contractual interest rate on a bond

Q40: Norlan Company does not ring up sales

Q43: Gomez Corporation issues 900, 10-year, 8%, $1,000

Q44: Sparks Company received proceeds of $634,500 on

Q45: Which of the following is not a

Q46: Winrow Company received proceeds of $754,000 on

Q47: Metropolitan Symphony sells 200 season tickets for

Q51: The current portion of long-term debt should<br>A)

Q62: When the effective interest method of amortization