Multiple Choice

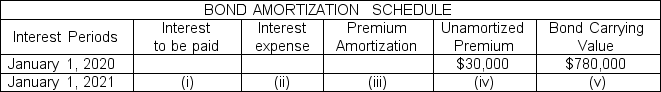

The following partial amortization schedule is available for Courtney Company who sold $750,000, five-year, 10% bonds on January 1, 2020, for $780,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (ii) ?

Which of the following amounts should be shown in cell (ii) ?

A) $81,000

B) $69,000

C) $78,000

D) $60,000

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Sales taxes collected by a retailer are

Q147: Which of the following statements concerning bonds

Q151: From the standpoint of the issuing company,

Q160: Restoration Company issued bonds that had the

Q161: Bonds with a face value of $600,000

Q162: The times interest earned is computed by

Q163: Hulse Corporation retires its $800,000 face value

Q166: Thayer Company purchased a building on January

Q167: The interest charged on a $300,000 note

Q169: Parker Company issued ten-year, 9%, bonds payable