Short Answer

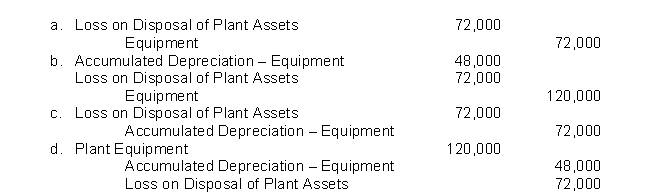

In 2022, Blanchard Corporation has plant equipment that originally cost $120,000 and has accumulated depreciation of $48,000.A new processing technique has rendered the equipment obsolete, so it is retired.Which of the following entries should Blanchard use to record the retirement of the equipment?

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Depreciation is a process of<br>A) asset devaluation.<br>B)

Q165: The four subdivisions of plant assets are<br>A)land,

Q166: The asset turnover is calculated as net

Q167: On November 1, 2021, Lovett Company places

Q168: The term applied to the periodic expiration

Q171: In the notes to the financial statements,

Q172: A loss on disposal of a plant

Q174: An asset was purchased for $140,000.It had

Q175: The following information is provided for Nguyen

Q296: Under the double-declining-balance method the depreciation rate