Multiple Choice

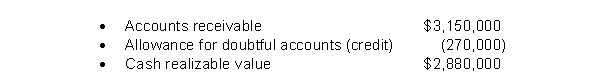

The following information is related to December 31, 2021 balances.  During 2022, sales on account were $870,000 and collections on account were $516,000.The company wrote off $48,000 in uncollectible accounts.An analysis of outstanding receivable accounts at year-end indicated that bad debts should be estimated at $324,000.The change in the cash realizable value from the balance at 12/31/21 to 12/31/22 was a

During 2022, sales on account were $870,000 and collections on account were $516,000.The company wrote off $48,000 in uncollectible accounts.An analysis of outstanding receivable accounts at year-end indicated that bad debts should be estimated at $324,000.The change in the cash realizable value from the balance at 12/31/21 to 12/31/22 was a

A) $300,000 increase.

B) $354,000 increase.

C) $252,000 increase.

D) $306,000 increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Under the allowance method the cash realizable

Q87: If bad debt losses are significant, the

Q88: When the due date of a note

Q89: The expense recognition principle<br>A)requires that all credit

Q90: The interest rate for a three-month loan

Q93: The expense recognition principle relates to credit

Q95: The percentage of receivables basis of estimating

Q96: The allowance method of accounting for bad

Q97: One might infer from a debit balance

Q145: Uncollectible accounts must be estimated because it