Multiple Choice

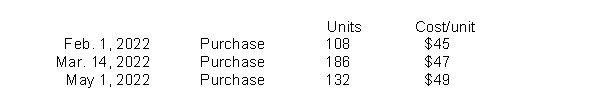

Hogan Industries had the following inventory transactions occur during 2022:  The company sold 306 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, and operating expenses of $1,800, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 306 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, and operating expenses of $1,800, what is the company's after-tax income using LIFO? (rounded to whole dollars)

A) $2,832

B) $3,288

C) $2,302

D) $1,982

Correct Answer:

Verified

Correct Answer:

Verified

Q75: The specific identification method of costing inventories

Q110: The LIFO reserve is the difference between

Q111: Which inventory costing method should a gasoline

Q112: Under the periodic inventory system, both the

Q113: On May 1, 2022, Heineken Company had

Q117: Automobile Audio has the following inventory data:

Q118: Technology has made the periodic inventory system

Q119: Which statement concerning lower-of-cost-or-net-realizable-value (LCNRV) is incorrect?<br>A)LCNRV

Q120: Ace Company is a retailer operating in

Q204: Management may choose any inventory costing method