Multiple Choice

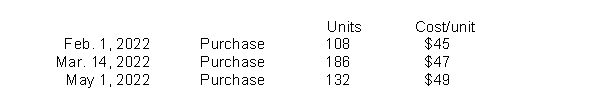

Hogan Industries had the following inventory transactions occur during 2022:  The company sold 306 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used and operating expenses of $1,800, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 306 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used and operating expenses of $1,800, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $2,832

B) $3,288

C) $2,302

D) $1,982

Correct Answer:

Verified

Correct Answer:

Verified

Q40: A problem with the specific identification method

Q60: If the ownership of merchandise passes to

Q61: When is a physical inventory usually taken?<br>A)When

Q63: An aircraft company would most likely have

Q66: Which inventory method generally results in costs

Q67: If beginning inventory is understated by $10,000,

Q69: Delightful Discs has the following inventory data:.

Q122: Independent internal verification of the physical inventory

Q131: In periods of rising prices the inventory

Q189: If a company has no beginning inventory