Multiple Choice

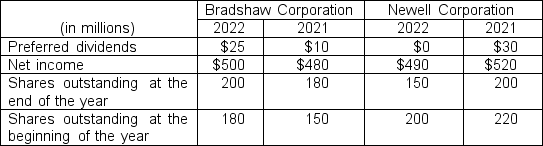

The following information is available for Bradshaw Corporation and Newell Corporation:  Based on the information for both Bradshaw and Newell over the two-year period, the earnings per share calculations (rounded to two decimals) indicate that

Based on the information for both Bradshaw and Newell over the two-year period, the earnings per share calculations (rounded to two decimals) indicate that

A) Bradshaw is seeing a greater performance improvement than Newell.

B) the earnings available to common stockholders is decreasing for Newell and increasing for Bradshaw.

C) the earnings per share calculations for both companies assume that changes in shares between 2021 and 2022 occur in the middle of the year.

D) Newell is more financially stable than Bradshaw.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The debt to assets ratio is computed

Q35: Liquidity ratios measure the short-term ability of

Q36: The investment category on the balance sheet

Q37: A measure of profitability is<br>A)the current ratio.<br>B)the

Q38: On a classified balance sheet, intangible assets

Q40: Which of the following would not be

Q41: The information needed to determine if companies

Q42: A material item is one that is

Q43: The Mac Company has four plants nationwide

Q44: These are selected account balances on December