Short Answer

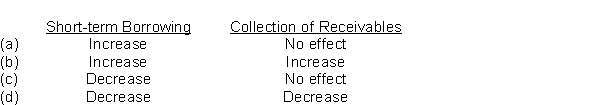

If a company has a current ratio of 1.3:1, what effects will the borrowing of cash by short-term debt and collection of accounts receivable have on the ratio?

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Asset turnover ratio is calculated as<br>A)sales divided

Q92: Assets and liabilities of a discontinued operation

Q93: If the average collection period is 45

Q94: All of the following statements about vertical

Q95: Leveraging and return on common shareholders' equity

Q97: Long-term creditors are usually most interested in

Q98: As companies increase leverage,<br>A)the difference between the

Q99: Even if a company has a low

Q100: Shareholders are most interested in evaluating<br>A)liquidity.<br>B)solvency.<br>C)profitability.<br>D)marketability.<br>

Q101: A supplier to a company would be