Short Answer

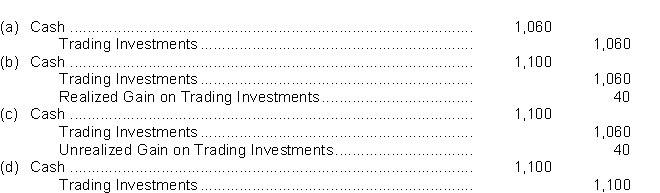

On January 1, Saskatoon Corporation purchased as a trading investment a $1,000, 6% bond for $1,060.The bond pays interest on January 1 and July 1.After receiving and recording the interest, the bond is sold on July 1 for $1,100.What is the entry to record the cash proceeds at the time the bond is sold?

Correct Answer:

Verified

Correct Answer:

Verified

Q12: At acquisition, the investment account is debited

Q13: When investing excess cash for short periods

Q14: Frisbee Inc.owns a 30% interest in the

Q15: The receipt of dividends from an investment

Q16: Use the following information for questions <br>On

Q18: Use the following information to answer questions

Q19: When a company controls the common shares

Q20: Eurythmics Ltd.owns 20% interest in the shares

Q21: Under the equity method of accounting for

Q22: "Other comprehensive income" does not include<br>A)revaluations of