Multiple Choice

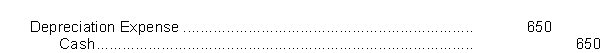

A new accountant working for Astro Limited records $650 depreciation expense on store equipment at year end as follows:  The effect of this entry is to

The effect of this entry is to

A) adjust the accounts correctly at year end.

B) understate expenses on the statement of income.

C) overstate the carrying amount of the depreciable assets at year end.

D) understate the carrying amount of the depreciable assets at year end.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Closing entries are prepared before adjusting entries.

Q2: Prepaid expenses are<br>A)paid and recorded in an

Q4: The process that begins with analyzing transactions

Q6: A common method for calculating depreciation expense

Q7: Failure to prepare an adjusting entry at

Q8: The carrying amount of a depreciable asset

Q9: The preparation of adjusting entries<br>A)is straight-forward because

Q10: The adjusting entry for deferred revenues result

Q11: Depreciation is the process of<br>A)valuing an asset

Q104: Closing entries result in the transfer of