Multiple Choice

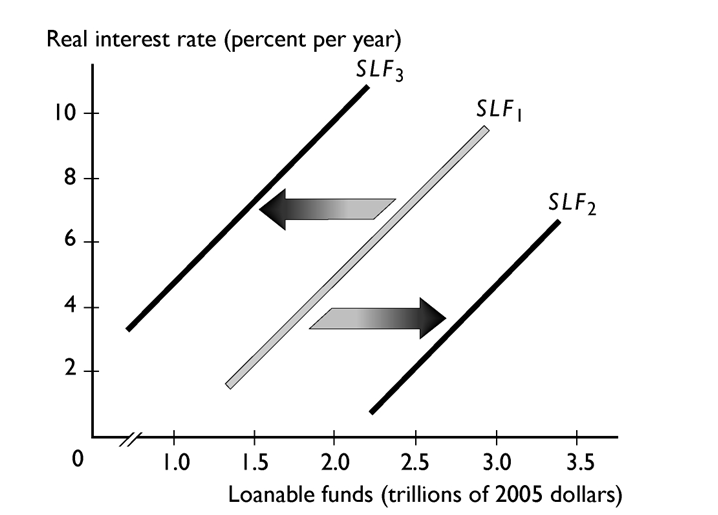

Suppose that the initial supply of loanable funds curve is SLF1. In the figure above, an increase in the real interest rate leads to

I. a shift in the supply of loanable funds curve from SLF1 to SLF2.

Ii. a shift in the supply of loanable funds curve from SLF1 to SLF3.

iii. a movement along the supply of loanable funds curve SLF1.

Iv. no change whatever.

A) i and iii

B) ii only

C) iii only

D) i only

E) iv only

Correct Answer:

Verified

Correct Answer:

Verified

Q20: During a recession, firms' expected profit from

Q21: Gross investment equals<br>A)net investment financial investment.<br>B)gross financial

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2787/.jpg" alt=" In the

Q23: What happens to the demand for loanable

Q24: <span class="ql-formula" data-value="\begin{array}{lllll}&\text { Investment } &

Q26: Which of the following is correct?<br>A)The change

Q27: If the real interest rate rises, then

Q28: An example of financial capital is<br>A)computers.<br>B)bonds.<br>C)machines.<br>D)the talents

Q29: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2787/.jpg" alt=" The figure

Q30: The quantity of loanable funds supplied increases