Multiple Choice

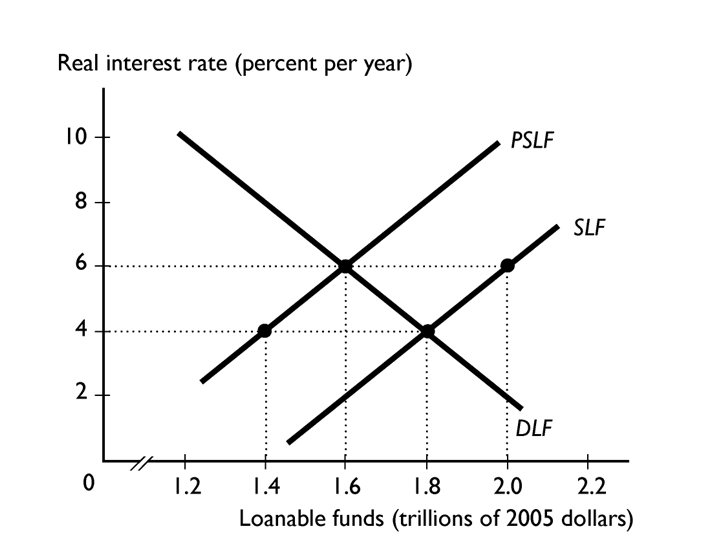

In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve.

- If there is no ricardo-Barro effect and the government now runs a balanced budget, the

A) there is shortage of investment funds of $0.4 trillion.

B) interest rate will increase from 4 percent to 6 percent.

C) there is a surplus of investment funds and the interest rate falls to 4 percent.

D) equilibrium interest rate is 4 percent and investment is $1.8 trillion.

E) equilibrium interest rate is 6 percent and investment is $1.6 trillion.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: If there is no Ricardo-Barro effect, a

Q13: The crowding-out effect is the tendency for<br>A)higher

Q14: If expectations about future income change, there

Q15: When<sub>--------------------</sub>changes, the supply of loanable funds curve

Q16: Technological change can increase the demand for

Q18: As a result of the government's rescue

Q19: The demand for loanable funds curve shows

Q20: During a recession, firms' expected profit from

Q21: Gross investment equals<br>A)net investment financial investment.<br>B)gross financial

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2787/.jpg" alt=" In the