Multiple Choice

Figure 12-3

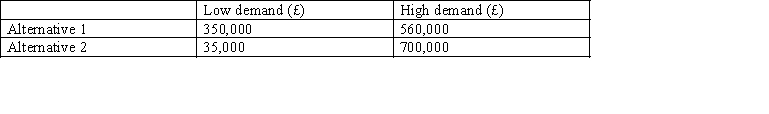

The Lee Company must choose between two mutually exclusive alternatives. With alternative 1 an inferior product will be marketed that is best suited to low levels of demand whereas alternative 2 is a superior product that is best suited to high levels of demand. There are only two possible levels of demand - high and low and the probabilities of each event occurring is 0.5. The predicted profits for each alterative are:

-Refer to Figure 12-3. Using the data above relating to the Lee Company, what is the amount of regret that is used to determine the choice of alternatives under consideration?

A) £140,000

B) £210,000

C) £665,000

D) £315,000

E) It is not possible to apply the regret criterion to the data given.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The joint probability of two events occurring

Q7: The most likely outcome represents:<br>A)the expected value.<br>B)the

Q10: Figure 12-3<br>The Lee Company must choose between

Q11: The following represent the expected values and

Q12: The decision rule under the maximin criterion

Q12: Figure 12-1<br>Joe Bloggs is considering the following

Q13: Sentosa Company is considering launching a new

Q14: The maximum amount that is worth paying

Q14: Figure 12-2<br>ZX Company is faced with choosing

Q16: Figure 12-2<br>ZX Company is faced with choosing