Multiple Choice

Table 29-8

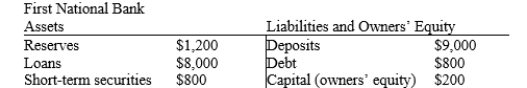

-Refer to Table 29-8. The required reserve ratio is 12 percent and First National Bank sells $120 of its short-term securities to the Federal Reserve. This action will

A) increase First National's reserves by $120. Its excess reserves are $240.

B) decrease First National's reserves by $120. Its excess reserves are $0.

C) increase First National's loans by $120. Its reserves decrease by $120.

D) decrease First National's loans by $120. Its reserves increase by $120.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: M1 includes<br>A)currency.<br>B)demand deposits.<br>C)traveler's checks.<br>D)All of the above

Q8: The Fed can decrease the money supply

Q16: The members of the Federal Reserve's Board

Q34: A central bank's setting (or altering)of the

Q44: The money multiplier equals 1/(1 - R),

Q80: Suppose a bank has $3,000 in reserves,

Q94: If the discount rate is raised then

Q95: The reserve requirement is 4 percent,banks hold

Q333: Table 29-4.<br>The First Bank of Fairfield <img

Q334: Table 29-1. The information in the table