Essay

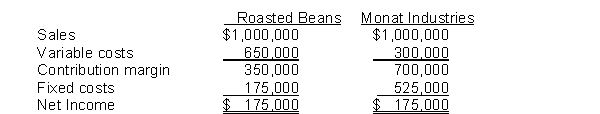

An investment banker is analyzing two companies that specialize in the production and sale of gourmet cappuccino and chai mixes. Roasted Beans Co. uses a labor-intensive approach and Monat Industries uses a mechanized system. Variable costing income statements for the two companies are shown below:

The investment banker is interested in acquiring one of these companies. However, she is concerned about the impact that each company's cost structure might have on its profitability.

Instructions

(a) Calculate each company's degree of operating leverage.

(b) Determine the effect on each company's net income if sales decrease by 10% and if sales increase by 15%. Do not prepare income statements.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Capitol Manufacturing sells 4,000 units of Product

Q28: A cost structure which relies more heavily

Q33: Hewitt Co. has 4,000 machine hours available

Q35: Kindle, Inc. manufactures cosmetic products that are

Q38: The following CVP income statements are available

Q75: In 2016, Teller Company sold 3,000 units

Q76: The weighted-average contribution margin of all the

Q95: Hinge Manufacturing's cost of goods sold is

Q104: The contribution margin ratio is<br>A) sales divided

Q105: If a company has limited machine hours