Essay

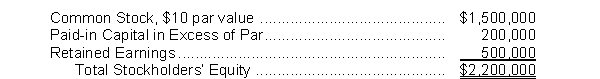

Yates Corporation has the following stockholders' equity accounts on January 1, 2018:

The company uses the cost method to account for treasury stock transactions. During 2018, the following treasury stock transactions occurred:

April 1 Purchased 10,000 shares at $19 per share.

August 1 Sold 4,000 shares at $22 per share.

October 1 Sold 2,000 shares at $15 per share.

Instructions

(a) Journalize the treasury stock transactions for 2018.

(b) Prepare the Stockholders' Equity section of the balance sheet for Yates Corporation at December 31, 2018. Assume net income was $110,000 for 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: A large stock dividend and stock split

Q26: Stockton Corporation has 160,000 shares of $5

Q49: Three dates are important in connection with

Q104: A company would not acquire treasury stock<br>A)

Q149: The per share amount normally assigned by

Q154: Retained earnings are occasionally restricted<br>A) to set

Q165: The par value of a stock<br>A) is

Q180: Dividends in arrears on cumulative preferred stock

Q180: The amount of a cash dividend liability

Q320: Trane Corporation has the following stockholders' equity