Essay

On January 1, 2016 Grier Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2017 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Grier Company uses the straight-line method of depreciation.

Instructions

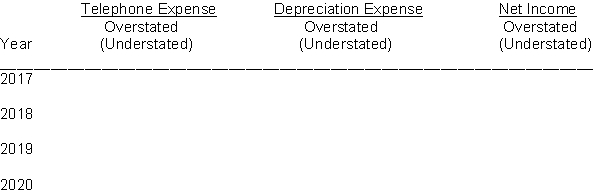

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2017 through the useful life of the new equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Intangible assets are the rights and privileges

Q62: Accountants do not attempt to measure the

Q129: Salem Company hired Kirk Construction to construct

Q146: A plant asset was purchased on January

Q180: Each of the following is used in

Q183: A plant asset was purchased on January

Q193: To determine a new depreciation amount after

Q236: Research and development costs which result in

Q249: A company purchased factory equipment on June

Q296: Under the double-declining-balance method the depreciation rate