Essay

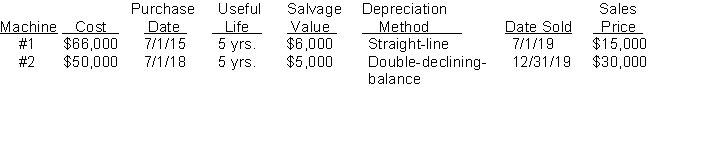

Grayson's Lumber Mill sold two machines in 2019. The following information pertains to the two machines:

Instructions

(a) Compute the depreciation on each machine to the date of disposal.

(b) Prepare the journal entries in 2019 to record 2019 depreciation and the sale of each machine.

Correct Answer:

Verified

**$30,000...

**$30,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Improvements are<br>A) revenue expenditures.<br>B) debited to an

Q59: Units-of-activity is an appropriate depreciation method to

Q65: To qualify as natural resources in the

Q149: A company purchased factory equipment for $700000.

Q197: Mather Company purchased equipment on January 1,

Q204: The cost of natural resources is not

Q212: Paneling the body of an open pickup

Q229: The IRS does not require the taxpayer

Q236: The entry to record depletion expense<br>A) decreases

Q277: Identify the following expenditures as capital expenditures