Short Answer

Listed below are items that may be useful in preparing the March 2018, bank reconciliation for Walker Machine Works.

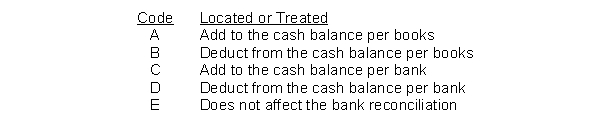

Using the following code, insert in the space before each item the letter where the amount would be located or otherwise treated in the bank reconciliation process.

1. Included with the bank statement materials was a check from Bob Simpson for $40 stamped "account closed."

2. A personal deposit by Annie Walker to her personal account in the amount of $300 for dividends on her General Electric common stock was credited to the company account.

3. The bank statement included a debit memorandum for $22.00 for two books of blank checks for Walker Machine Works.

4. The bank statement contains a credit memorandum for $24.75 interest on the average checking account balance.

5. The daily deposits of March 30 and March 31, for $3,362 and $3,125 respectively, were not included in the bank statement postings.

6. Two checks totaling $316.86, which were outstanding at the end of February, cleared in March and were returned with the March statement.

7. The bank statement included a credit memorandum dated March 28, 2018, for $45.00 for the monthly interest on a 6-month, $15,000 certificate of deposit that the company owns.

8. Four checks, #8712, #8716, #8718, #8719, totaling $5,369.65, did not clear the bank during March.

9. On March 24, 2018, Walker Machine Works delivered to the bank for collection a $2,500, 3-month note from Don Decker. A credit memorandum dated March 29, 2018, indicated the collection of the note and $90.00 of interest.

10. The bank statement included a debit memorandum for $25.00 for the collection service on the above note and interest.

Correct Answer:

Verified

1. B 6. E

2. D 7. A

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2. D 7. A

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The cash balance per books for Feagen

Q9: The following adjusting entries for Donkey Company

Q10: The cash account shows a balance of

Q11: Controls that enhance the accuracy and reliability

Q31: Deposits in transit<br>A) have been recorded on

Q96: Riley Company received a notice with its

Q104: Replenishing the petty cash fund requires<br>A) a

Q161: The responsibility for ordering receiving and paying

Q162: Compensating balances are a restriction on the

Q232: In the month of November, Kinsey Company