Essay

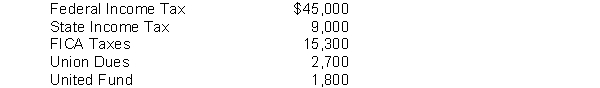

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and also the employer's payroll tax expense on the payroll.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Ann Hech's regular hourly wage is $18

Q12: An employee's time card is used to

Q15: A Wage and Tax Statement shows gross

Q16: Match the procedures listed below with the

Q20: Match the items below by entering the

Q22: Sam Geller had earned (accumulated) salary of

Q25: Match the items below

Q36: The form showing gross earnings, FICA taxes

Q147: FICA taxes withheld and federal income taxes

Q196: The effective federal unemployment tax rate is