Essay

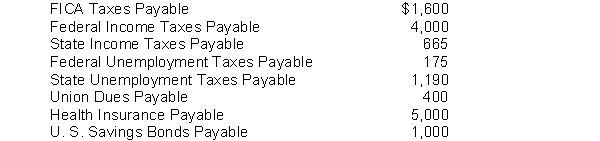

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The state unemployment tax rate is usually

Q4: A good internal control feature is to

Q6: Which of the following is not performed

Q11: Which one of the following payroll taxes

Q19: FICA taxes and federal income taxes are

Q24: An employee earnings record is a cumulative

Q28: Most companies are required to compute overtime

Q38: Match the codes assigned to the following

Q137: By January 31 following the end of

Q159: The employer incurs a payroll tax expense