Essay

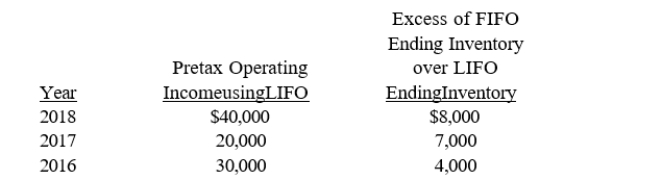

Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2018. The following data were available:  The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2017-2018 comparative financial statements.

a. What is net income for 2018?

b. What is restated net income for 2017?

c. Prepare the 2017 statement of retained earnings as it would appear in the comparative

2017-2018 financial statements.

Correct Answer:

Verified

Reminder: The change in cost of goods so...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: The correct 2016 net income for Magness

Q106: Exhibit 22-5<br>Daniel Company, having a fiscal year

Q107: A change in accounting principle because an

Q108: The correction of an error in the

Q109: On January 1, 2016, Sarah Company purchased

Q111: The Catherine Company, effective January 1, 2018,

Q112: Refer to Exhibit 22-1. Assuming an income

Q113: When making a retrospective adjustment, all of

Q114: The December 31, 2016, ending inventory

Q115: An example of a change in accounting