Short Answer

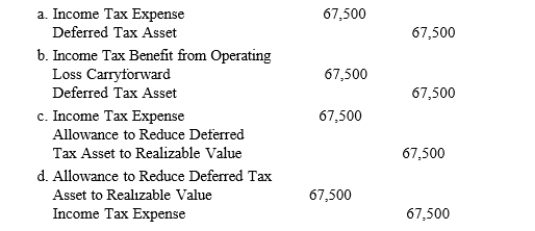

During its first year of operations, 2016, the Cocoa Company reported both a pretax financial and a taxable loss of $300,000. The income tax rate is 30% for the current and future years. Due to a sufficient backlog of sales orders, Cocoa did not establish a valuation allowance to reduce the $90,000 deferred tax asset. However, early in 2017, one major customer, representing 60% of the 2017 year-end sales backlog, went bankrupt. Cocoa now believes that it is more likely than not that 75% of the deferred tax asset will not be realized. The entry to record the valuation allowance would be

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A deferred tax asset would result if<br>A)

Q4: Differences between pretax financial income and taxable

Q5: In 2016, its first year of operations,

Q5: An operating loss carryforward occurs when<br>A)prior pretax

Q6: Rice, Inc. began operations on January 1,

Q7: Identify the three essential characteristics of an

Q9: In 2016, the Puerto Rios Company received

Q12: Permanent differences arise due to timing differences

Q13: The value of deferred tax assets and

Q56: All of the following involve a temporary