Multiple Choice

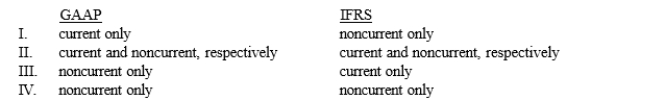

The acceptable balance sheet classifications for deferred tax assets and deferred tax liabilities under GAAP and IFRS are

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q49: On December 31, 2015, Jefferson Lake, Inc.

Q50: A temporary difference will result in a

Q51: Which of the following would not result

Q52: In 2016, its first year of operations,

Q53: When Congress makes a tax law or

Q55: A corporation's deferred tax expense or benefit

Q56: Which of the following statements appropriately describe

Q57: For the year ended December 31, 2016,

Q58: Fairfax Company had a balance in Deferred

Q59: Which one of the following requires interperiod