Essay

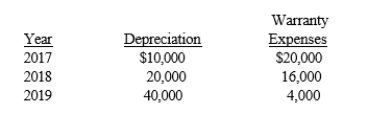

Delmarva Company, during its first year of operations in 2016, reported taxable income of $170,000 and pretax financial income of $100,000. The difference between taxable income and pretax financial income was caused by two timing differences: excess depreciation on tax return, $70,000; and warranty expenses in excess of warranty payments, $40,000. These two timing differences will reverse in the next three years as follows:  Enacted tax rates are 30% for 2016, 35% for 2017 and 2018, and 40% for 2019.

Enacted tax rates are 30% for 2016, 35% for 2017 and 2018, and 40% for 2019.

Required:

Prepare the income tax journal entry for Delmarva Company for December 31, 2016.

Correct Answer:

Verified

Correct Answer:

Verified

Q88: Port Deposit, Inc. reports the following deferred

Q89: Differences between pretax financial accounting and taxable

Q90: What are the three types of permanent

Q91: Which one of the following would require

Q92: Deductions that are allowed for income tax

Q94: Permanent differences between pretax financial income and

Q95: Intraperiod tax allocation would be appropriate for

Q96: Exhibit 18-1<br>On December 31, 2015, Fredericksburg, Inc.

Q97: Match each item to its descriptive phrase

Q98: What two issues does a company need