Multiple Choice

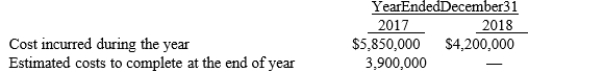

In 2017, Dygress Construction Co. began work on a contract for $16,500,000; it was completed in 2018. The following cost data pertain to this contract:  Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

A) $2,400,000

B) $2,695,000

C) $4,050,000

D) $6,450,000

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Noncash consideration should be recognized by the

Q55: Pizza-Iz-Us charges an initial fee of $1,800,000

Q56: The transaction price for multiple performance obligations

Q57: In January, Cigaro Corp. agrees to a

Q58: A customer agrees to pay a seller

Q60: What is the appropriate revenue recognition procedure

Q61: What type of account is Construction in

Q62: List indicators that a company may be

Q63: A good is considered distinct if it

Q64: If a contract modification does not create