Essay

Moover Construction enters into a contract with a customer to build a warehouse for $900,000 on June 30, 2017, with a performance bonus of $60,000 if the building is completed by October 31, 2017. The bonus is reduced by

$20,000 each week that completion is delayed. The contract also states that if the warehouse receives a favorable safety inspection rating from government inspectors by November 30, Moover will receive a performance bonus of

$40,000.

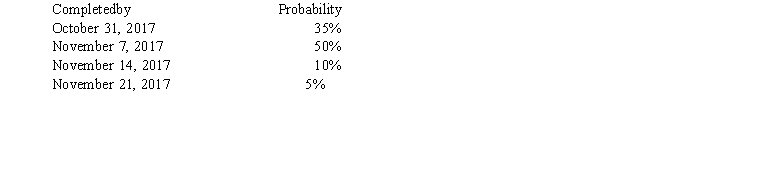

Moover commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:  In addition, Moover estimates there is a 90% chance that the warehouse will receive a favorable safety inspection rating upon timely completion.

In addition, Moover estimates there is a 90% chance that the warehouse will receive a favorable safety inspection rating upon timely completion.

Required:

a. Assume Moover uses the expected value approach. Determine the transaction price for this transaction.

b. Assume Moover uses the most likely amount approach. Determine the transaction price for this transaction.

Correct Answer:

Verified

a. 35% × $900,000 + $60,000) =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Given that the determination of a variable

Q24: Revenue is recognized for accounting purposes when

Q25: The Partial Billings account is a contra

Q26: On July 10, Boogie Footware agrees to

Q27: A contract may be written, oral, or

Q29: A Provision for Loss on Contract is

Q30: In July 2016, Sykick Software Company licenses

Q31: Panama Builders, Inc. signed a contract to

Q32: Revenues represent<br>A) increases in assets and/or decreases

Q33: On January 1, 2017, Carly Fashions Inc.