Essay

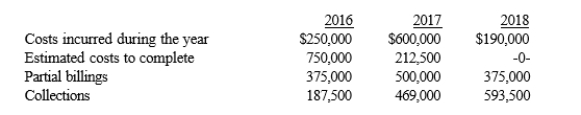

Thompson Construction began a construction project in 2016. The contract price was $1,250,000, and the estimated costs were $1,000,000. Data for each year of the contract are as follows:

Required:

Assuming Thompson satisfies its performance obligation over time, determine: 1) The balance of Construction in Progress at the end of 2016.

2) How the net amount for construction in progress inventory should be reported on the

2017 balance sheet.

3) The gross profit for 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Construction in Progress is an inventory account

Q2: On July 15, Zink Jewels agrees to

Q3: When multiple service-related performance obligations exist within

Q5: GAAP requires that incremental costs of obtaining

Q6: A contract asset<br>A) represents the seller's performance

Q7: Mary Streen is getting up to speed

Q8: The core principle of revenue recognition is

Q9: The role of the agent in a

Q10: If a contract involves a significant financing

Q11: If a contract modification is determined not