Essay

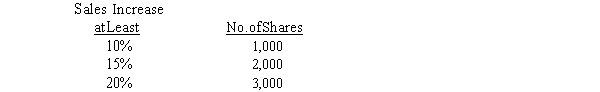

On January 1, 2016, Biggs Company granted a performance-based stock option plan to 40 executives to buy a maximum of 3,000 shares each of its $10 par common stock at $30 a share. The fair value per option is $8. The terms of the plan, which has a three-year service and vesting period, are based on the following scale:

Biggs expects an annual employee turnover rate of 3%, and the company initially anticipates an increase in sales during the service period of 18%. By the end of 2019, the actual sales increase is 17%.

Required:

a. Compute the estimated total compensation cost.

b. Compute the annual compensation expense for each of the three years.

c. Prepare the January 1, 2016, entry when 10 executives exercise their options.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: The legal capital of a corporation may

Q84: Which of the following methods should be

Q85: Which of the following share option plans

Q86: Exhibit 15-9<br>Groundcover, Inc. had never had a

Q87: Several years ago, Walther, Inc. issued 12,000

Q88: What are share based compensation plans?

Q90: Preferred shareholders share with common shareholders in

Q93: On January 1, 2016, sixty executives are

Q94: Exhibit 15-8<br>On January 1, 2016, Margarita Company

Q100: Which of the following is not a