Essay

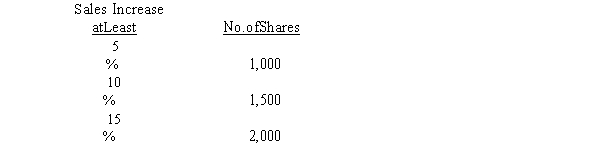

On January 1, 2016, Asquith Company adopts a performance-based stock option plan with a four-year vesting and service period, a $35 exercise price, and a $6 per option fair value. The plan grants a maximum of 2,000 shares of $5 par common stock to each of the company's 30 executives. The number of shares that vest depends on the increase in sales during the service period, based on the following scale:  Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan 2016 through 2020).

Correct Answer:

Verified

January 1, 2016:

Mem...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Mem...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Dividends in arrears pertain to .<br>A) non-cumulative

Q32: FASB requires companies to provide disclosure regarding

Q33: Below is information obtained from Carver's 2016

Q34: Under a restricted share plan, the employees

Q35: The authorized shares of capital stock is

Q37: On January 1, 2016, Nelson Company gave

Q38: The Securities and Exchange Commission requires that

Q39: Fully participating preferred shareholders receive extra dividends

Q40: When a company reacquires its own stock,

Q41: Martian Magic issued 800 shares of $50