Essay

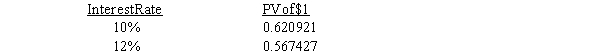

On January 1, 2016, the Porter Corporation issued a five-year, non-interest-bearing, $44,000 note to Longshore Corporation in exchange for used equipment. Neither the fair market value of the equipment nor that of the note is determinable. The incremental borrowing rate of Porter is 12% and the incremental borrowing rate of Longshore is

10%. Present value factors for n = 5 years are  Required:

Required:

a. Prepare the journal entry to record the issuance of the note by Porter on January 1, 2016.

b. Prepare the journal entry to record the interest expense on December 31, 2016.

c. Prepare the journal entry to record the interest expense on December 31, 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On April 1, 2013, Bond Corporation issued

Q5: Exhibit 14-16<br>Harry's Inc. issued a four-year, $75,000,

Q6: GAAP requires the borrowers to record the

Q7: Two methods of amortization of a discount

Q10: Exhibit 14-8<br>Piazzi, Inc. sold $400,000 of its

Q11: The straight-line method of amortization assumes a

Q14: On January 1, 2016, the Keller Co.

Q48: A theoretical difference between the effective interest

Q86: The interest rate used by the creditor

Q129: Which statement is true?<br>A)The carrying amount of