Essay

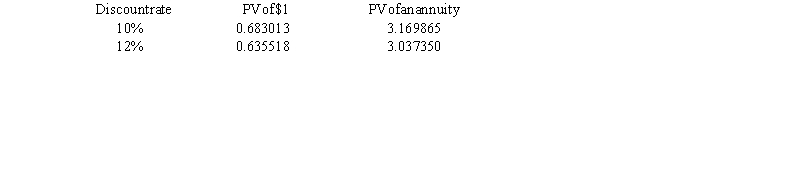

On December 31, 2015, Albright Bank restructures an $800,000, 12% note receivable with $192,000 of accrued interest so that the new principal is $750,000, payable in four years at 10%. Present value factors for n = 4 years are:  Required:

Required:

a. Prepare the journal entry to record the loss on restructuring.

b. Prepare the journal entry to record the 2015 interest revenue.

c. Compute the carrying value of the note on December 31, 2013.

d. Compute the carrying value of the note on December 31, 2019 before the payment is received.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Siena sold $120,000 of 6% bonds for

Q21: Exhibit 14-2<br>A $500,000, ten-year, 7% bond issue

Q22: In the event of a debt restructuring,

Q24: When the market rate of interest is

Q26: Exhibit 14-10<br>Hawk issued $500,000 of its ten-year

Q28: Which of the following statements is false?<br>A)

Q29: Nassau Co. owes Dominion Ltd. $115,000 on

Q30: Which of the following is not a

Q37: The effective interest method of amortization assumes

Q138: The rate of interest used to compute