Multiple Choice

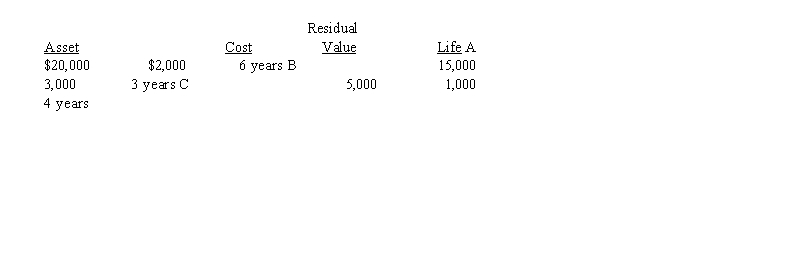

On January 1, 2016, Mullhausen Co. began using the composite depreciation method. There were three machines to consider, as follows:  At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

A) $1,200 debit to Gain on Sale of Machine

B) $6,800 debit to Accumulated Depreciation

C) $6,800 debit to Loss on Sale of Machine

D) $8,000 debit to Accumulated Depreciation

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Which depreciation method ignores residual value when

Q123: On January 1, 2016, the Mills Car

Q124: The Chuck Company purchased a truck on

Q125: In 2016, Western Maryland Company paid $3,000,000

Q126: Hill has a fiscal year-end of December

Q127: Mark Industries uses the straight-line depreciation method.

Q129: Exhibit 11-05<br>Wilson is preparing his tax returns

Q130: A requirement of GAAP is that companies

Q131: Exhibit 11-1<br>On January 1, Year 1, Hills

Q132: Exhibit 11-03<br>On January 1, 2016, Wheeler, Inc.