Multiple Choice

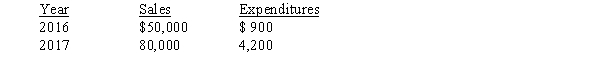

American Business Services introduced a new machine on January 1, 2016. The machine carried a two-year warranty against defects. The estimated warranty costs related to dollar sales were 3% in the year of sale and 5% in the year after sale. Additional information follows: Actual Warranty  If American Business Services considers these warranties to be assurance-type and accounts for them by accruing the expense and the related liability) in the year of the sale, what amount relating to warranties should be reflected on the December 31, 2017, balance sheet?

If American Business Services considers these warranties to be assurance-type and accounts for them by accruing the expense and the related liability) in the year of the sale, what amount relating to warranties should be reflected on the December 31, 2017, balance sheet?

A) $5,300

B) $6,400

C) $6,500

D) $9,100

Correct Answer:

Verified

Correct Answer:

Verified

Q11: How are current liabilities classified? Provide an

Q12: Existing claims related to product warranties and

Q13: Excellence, Inc., places a coupon in

Q14: Concerning accounting for warranties, which of the

Q16: Exhibit 9-1<br>The Happy Cereal Company includes a

Q17: Unearned revenue also called deferred revenue) can

Q18: Current liabilities are obligations of a company

Q20: What are the FASB's broad guidelines for

Q31: Under current standards of the FASB, liabilities

Q53: The operating cycle is typically defined as