Multiple Choice

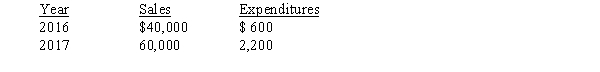

Albert Corp. introduced a new machine on January 1, 2016. The machine carried a two-year assurance-type warranty against defects. The estimated warranty costs related to dollar sales were 3% in the year of sale and 5% in the year after sale. Additional information follows: Actual Warranty  If the company uses the GAAP approach of accruing warranty expense and the related liability) in the year of the sale, what amount relating to warranty expense should be reflected on the December 31, 2017 income statement?

If the company uses the GAAP approach of accruing warranty expense and the related liability) in the year of the sale, what amount relating to warranty expense should be reflected on the December 31, 2017 income statement?

A) $2,200

B) $4,800

C) $5,200

D) $7,400

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The modified cash basis to determine warranty

Q61: Which payroll tax is imposed on both

Q68: Which of the following statements does not

Q104: King Sales sells a certain product for

Q105: Vacation pay and year-end bonuses would be

Q106: Exhibit 9-2<br>In 2015, the Magtag Company sold

Q108: Short-term debt that is expected to be

Q110: Baynard Boats, Inc. presented the following information

Q113: Cooper's inventory has been financed 100% with

Q114: Assume that a company is facing a