Essay

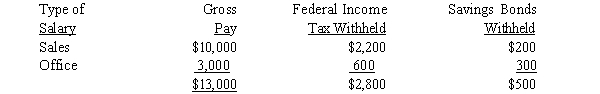

Natural Hair reports the following payroll information for May, 2015:  Tax rate information follows:

Tax rate information follows:

FICA 7.0%

Federal unemployment 0.8%

State employment 5.4%

Assume that all wages are subject to all payroll taxes.

Required:

Prepare the journal entries to record the payment of the May, 2015, payroll and to record the payroll taxes imposed on the employer.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: All of the following are examples of

Q90: Listed below are several types of contingencies

Q91: Concerning accounting for warranties, which of the

Q92: Marble Co. employs a staff of 35

Q93: On January 1, 2017, Sweet Treats Inc.

Q96: On December 31, 2016, the Wagner Company

Q97: Exhibit 9-2<br>In 2015, the Magtag Company sold

Q98: According to current GAAP, which of the

Q99: Exhibit 9-3<br>John Company includes three coupons in

Q100: On December 1, 2015, Sons, Inc. borrowed