Essay

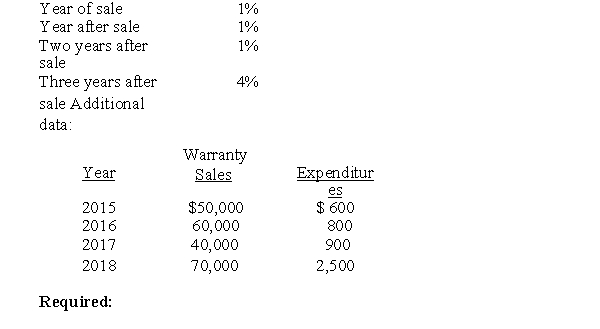

Munster sells a product with a four-year warranty. Warranty costs are estimated as a percentage of sales as follows:

a. If this is an assurance-type warranty and the company uses the modified cash method, what would be warranty expense for 2017?

b. If this is an assurance-type warranty and and the company uses the GAAP approach of accruing warranty expense and the related liability) in the year of the sale, what would be warranty expense for 2017?

c. If the company considers that 7% of the selling price of the produce represents payment for an implied service-type warranty, what amount of unearned warranty revenue would be disclosed on the balance sheet on December 31, 2018?

Correct Answer:

Verified

a. $900

b. .07 × $40...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. .07 × $40...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Which of the following statements concerning contingencies

Q37: From the list of accounts below determine

Q38: Compensated absences include vacation, holiday, sick, or

Q39: Sick pay benefits that are related to

Q41: Vanity Dog Products had the following account

Q41: Which of the following statements is true?<br>A)GAAP

Q42: List five examples of liabilities whose amounts

Q44: The Captain Company began operations on January

Q80: All of the following payroll taxes are

Q85: Liabilities whose amounts must be estimated are