Multiple Choice

Exhibit 5-1

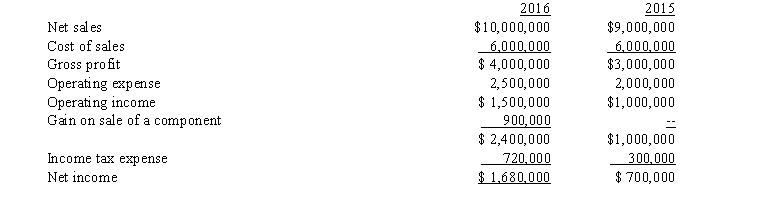

The following condensed income statement of Ranger Corporation is presented for the two years ended December 31, 2016 and 2015:  On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

2016 $700,000 loss

2015 $400,000 loss

Assume an income tax rate of 30%.

-Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should report income from continuing operations after income taxes for 2016 and 2015, respectively, amounting to

A) $1,540,000 and $700,000.

B) $1,540,000 and $980,000.

C) $1,680,000 and $700,000.

D) $1,680,000 and $980,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: The subtotal, gross profit, will be disclosed

Q33: The following information relates to Zhulu Corporation

Q34: A company is not required to follow

Q35: Together with the cash flow statement, the

Q36: Which of the following is not a

Q37: Which of the following would appear after

Q39: The gross profit of Larry Company for

Q41: Which of the following is not recognized

Q42: Which of the following are components of

Q43: Information reported or disclosed about the profit