Multiple Choice

Exhibit 5-1

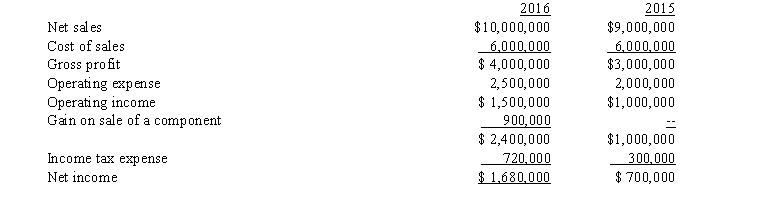

The following condensed income statement of Ranger Corporation is presented for the two years ended December 31, 2016 and 2015:  On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions for $2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifies as a discontinued component. This division's contribution to Ranger's reported income before income taxes for each year was as follows:

2016 $700,000 loss

2015 $400,000 loss

Assume an income tax rate of 30%.

-Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should report under the caption "Discontinued Operations" for 2016 and 2015, respectively,

A) income of $140,000 and a loss of $280,000.

B) income of $140,000 and a loss of $0.

C) income of $200,000 and a loss of $400,000.

D) a loss of $700,000 and a loss of $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: To compute earnings per share the denominator

Q12: In accrual accounting, net income is defined

Q13: Bradley's Inc.'s adjusted trial balance contains the

Q14: The numerator in the earnings per share

Q16: Gains or losses associated with derivative financial

Q17: In general, revenue is recognized<br>A) during the

Q18: Exhibit 5-2<br>The following is an income statement

Q19: Exhibit 5-2<br>The following is an income statement

Q20: Interperiod tax allocation involves apportioning a corporation's

Q63: Operating capability refers to<br>A)the ability of a