Essay

Jim has been employed at Gold Key Realty at a salary of $2,000 per month during the past year. Because Jim is considered to be a top salesman, the manager of Gold Key is offering him one of three salary plans for the next year: (1) a 25% raise to $2,500 per month; (2) a base salary of $1,000 plus $600 per house sold; or, (3) a straight commission of $1,000 per house sold. Over the past year, Jim has sold up to 6 homes in a month.

a. Compute the monthly salary payoff table for Jim.

b. For this payoff table find Jim's optimal decision using: (1) the conservative approach, (2) minimax regret approach.

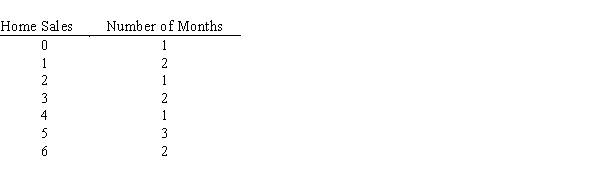

c. Suppose that during the past year the following is Jim's distribution of home sales. If one assumes that this a typical distribution for Jim's monthly sales, which salary plan should Jim select?

Correct Answer:

Verified

C.Use the relative frequ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

C.Use the relative frequ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: States of nature<br>A) can describe uncontrollable natural

Q3: Which of the methods for decision making

Q4: How can a good decision maker "improve"

Q6: ?A decision maker has chosen .4 as

Q8: Show how you would design a spreadsheet

Q9: When the decision maker prefers a guaranteed

Q11: A payoff table is given as<br> <img

Q12: Values of utility<br>A) must be between 0

Q60: The difference between the expected value of

Q73: For a minimization problem,the conservative approach is