Multiple Choice

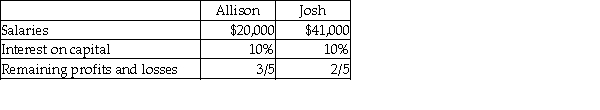

Allison and Josh are partners in a business. Allison's capital is $120,000 and Josh's capital is $120,000. Profits for the year are $80,000. They agree to share profits and losses as follows:  Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Allison's share of the profits before paying salaries and interest on capital is: (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $48,000.

B) $70,500.

C) $40,000.

D) $11,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: The journal entry to close net income

Q72: After several years of business, Abel, Barney,

Q73: Partners Eric and Jeremy each have $7,000

Q74: Which method of allocation of profits and

Q75: The original investment balances of partners Bridget

Q77: Joan and Helen are partners who have

Q78: Dissolution of a partnership can occur under

Q79: A partnership can be joined by:<br>A) investing

Q80: After several years of business, Abel, Barney,

Q81: Partner B invested inventory using the retail