Multiple Choice

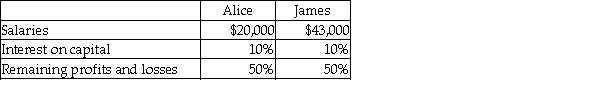

Alice and James are partners in a business. Alice's capital is $130,000 and James's capital is $170,000. Profits for the year are $130,000. They agree to share profits and losses as follows:  James's share of the profit is:

James's share of the profit is:

A) $52,000.

B) $65,000.

C) 39,000.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q104: Jean and Joy are partners, with beginning

Q105: The sale of assets for liquidation purposes

Q106: Indicate the account(s) to be debited and

Q107: A method of dividing net income or

Q108: Which of the following is an incorrect

Q110: Indicate the account(s) to be debited and

Q111: Indicate the account(s) to be debited and

Q112: In comparison with the proprietorship form of

Q113: Partners Brian, Josh, and Chad have capital

Q114: The partnership of Rick and Allan is